Introduction to Crypto Scams

In recent years, the rise of cryptocurrencies has opened up new avenues for investment and speculation. However, along with this growth has come an increase in cryptocurrency scams aimed at unsuspecting individuals. Cryptocurrency scams can take various forms, including phishing attacks, Ponzi schemes, fake exchanges, and fraudulent initial coin offerings (ICOs). These scams often exploit the lack of regulation in the crypto space and the general unfamiliarity of the public with the technologies involved.

The landscape of crypto scams has evolved significantly as scammers become more sophisticated in their tactics. Initially, scams were primarily centered around emails and basic phishing. Today, they can be found on social media platforms, messaging apps, and even through official-looking websites. Some scammers create complex narratives, utilizing high-pressure tactics and promises of guaranteed returns to lure victims. This evolution also reflects the increasing legitimacy and mainstream acceptance of cryptocurrencies, which can inadvertently provide cover for malicious activities.

According to recent reports, the prevalence of these scams is particularly alarming, with billions of dollars lost annually to fraudulent schemes within the crypto market. These figures highlight the necessity for heightened awareness among potential and current cryptocurrency investors. Understanding the common types of scams and the risks involved is crucial for anyone looking to engage in the crypto market.

As interest in cryptocurrencies continues to grow, it is equally important for individuals to remain vigilant. Education and awareness can serve as the best defense against becoming a victim of these scams. By recognizing the tactics employed by scammers and adopting best practices for security and due diligence, individuals can protect their investments and contribute to a healthier cryptocurrency ecosystem.

Types of Common Cryptocurrency Scams

As the cryptocurrency market continues to expand, so too does the number of scams targeting unsuspecting investors. Being aware of these scams is essential for individuals looking to safeguard their investments. This section focuses on some prevalent types of scams that frequently occur in the crypto space, providing a brief overview of each.

One of the most notorious scams is the Ponzi scheme, which offers high returns to early investors using the capital from new participants, rather than from legitimate profit. This unsustainable model eventually collapses when there are not enough new investors to pay the earlier ones, resulting in significant losses for many.

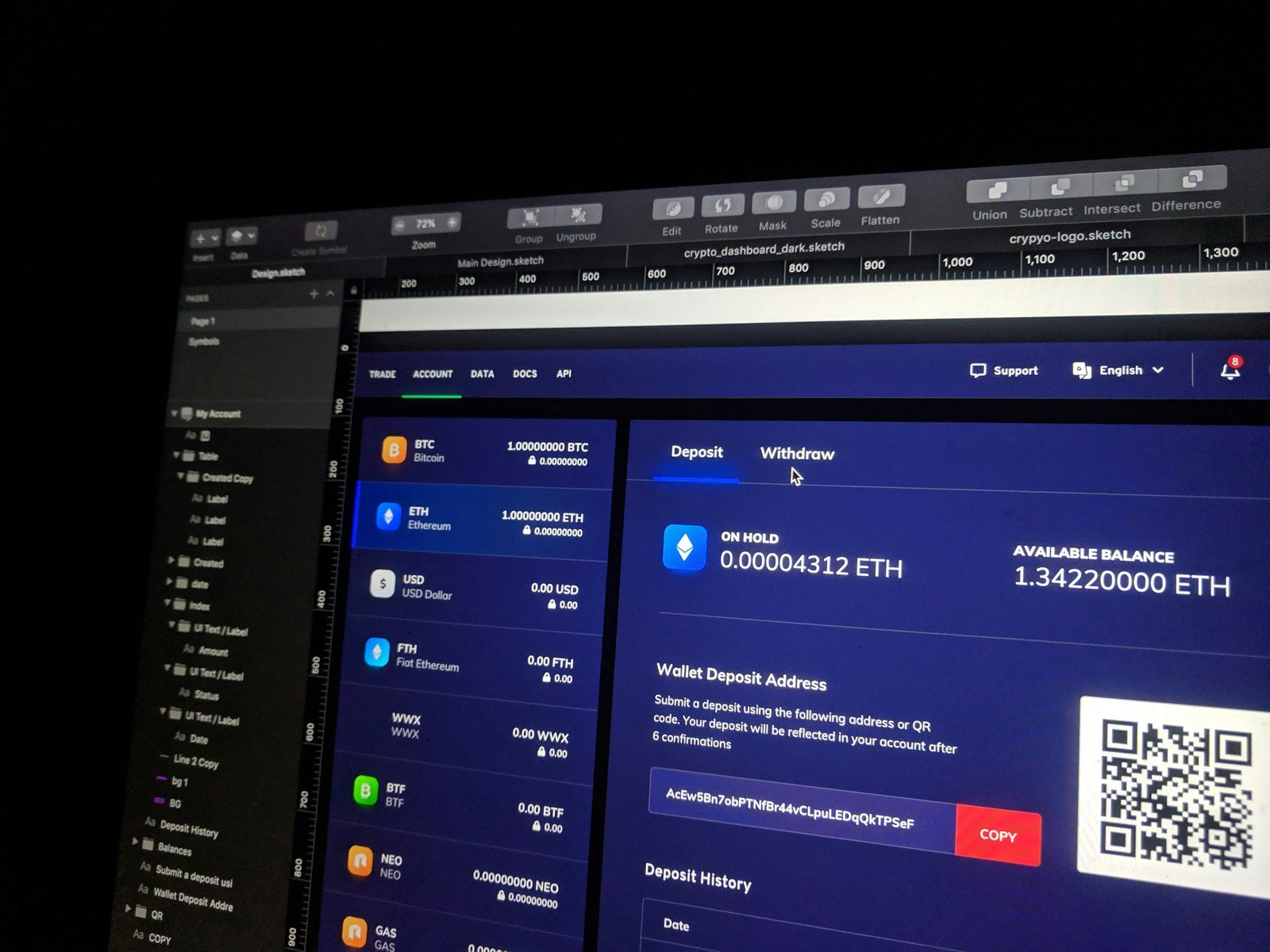

Phishing attacks are another common tactic employed by cybercriminals. These schemes typically involve deceptive emails or websites that mimic legitimate exchange platforms, tricking users into providing sensitive information such as passwords or private keys. This personal data can then be used to access the victim’s cryptocurrency holdings without their consent, leading to potential financial ruin.

Additionally, fake Initial Coin Offerings (ICOs) have emerged as a significant threat. These scams involve the creation of a seemingly legitimate cryptocurrency project that aims to raise funds through a public token sale. Once investors buy into the ICO, the perpetrators often vanish, leaving investors with worthless tokens.

Lastly, fraudulent exchanges can lure investors with attractive trading options and high security promises but ultimately fail to deliver. These platforms may operate without regulation, offering minimal protections for users and often resulting in the loss of funds without any recourse.

Recognizing these red flags in the cryptocurrency market is crucial for protecting oneself against potential scams. Awareness is the first step toward maintaining security in one’s cryptocurrency journey.

Understanding the Psychology Behind Scams

The proliferation of cryptocurrency scams can be attributed to various psychological factors that influence human behavior. These scams often prey on emotions such as greed and fear, which can cloud judgment and result in irrational decisions. One of the most common tactics used by scammers is the appeal to greed, presenting their schemes as unprecedented opportunities for wealth accumulation. This allure can be particularly potent in the world of cryptocurrencies, where potential returns on investment are often portrayed as high. When individuals are exposed to promises of significant profits with minimal effort, they may overlook warning signs and due diligence.

Urgency is another psychological element that scammers skillfully exploit. Many scams create a sense of immediate action, compelling victims to act quickly to avoid missing out on a once-in-a-lifetime investment opportunity. This pressure can result in hasty decisions and inadequate research, as potential investors feel they must act before the opportunity vanishes. By fostering a perception of urgency, scammers effectively shorten the decision-making process, reducing the likelihood that individuals will pause to think critically about the situation.

Misinformation further exacerbates the problem. In the realm of cryptocurrencies, where market dynamics are complex and continuously evolving, individuals may find themselves overwhelmed with conflicting information. Scammers leverage this confusion by presenting false but convincing narratives that align with their schemes. The lack of comprehensive knowledge about blockchain technology and its inherent risks can hinder a person’s ability to discern legitimate investments from deceitful ones. Education about these psychological manipulations is crucial; understanding how scammers exploit greed, urgency, and misinformation can significantly enhance an individual’s ability to recognize and avoid potential threats in the crypto space.

How to Spot a Scam: Red Flags to Look For

As the cryptocurrency landscape expands, the prevalence of scams increasingly poses a risk to investors. Recognizing common warning signs is crucial in safeguarding your investments and ensuring a positive experience within the crypto space. One of the first red flags to be aware of is the promise of disproportionately high returns. If an investment opportunity claims to yield returns that seem too good to be true, it likely is. Scammers often employ this tactic to lure unsuspecting victims with the allure of significant profits.

Another prevalent warning sign is receiving unsolicited offers, especially via email or social media platforms. Legitimate investment opportunities typically do not rely on cold outreach methods to gain interest from potential investors. Be cautious if you are approached for an investment without prior interaction—the likelihood of it being a scam is considerably high.

Furthermore, the quality of the website associated with the offer is telling. A poorly designed website, riddled with grammatical errors or lacking professional aesthetics, can be indicative of a fraudulent operation. Genuine businesses invest in their online presence and communicate credibility through well-maintained platforms. Always analyze the website for contact information, including phone numbers and physical addresses, as legitimate organizations will provide clear channels to address customer concerns.

It is also essential to employ tools and methods for verifying the legitimacy of investment opportunities. Research independent reviews and consult reputable sources in the crypto community. Moreover, familiarize yourself with cryptocurrency-specific forums where users share their experiences with various projects. By remaining vigilant and scrutinizing potential investments closely, you can significantly decrease the chances of falling victim to scams in the dynamic world of cryptocurrencies.

Security Best Practices for Cryptocurrency Users

In the ever-evolving world of cryptocurrency, maintaining security is paramount for users to safeguard their assets against various online scams. One of the foundational practices for securing digital assets is the utilization of secure wallets. Cryptocurrency wallets can be categorized into hardware and software wallets, with hardware wallets generally offering a higher level of security as they store the private keys offline. Users should consider investing in a reputable hardware wallet for long-term storage, while software wallets are often more suitable for daily transactions. Ensuring that these wallets are protected with strong, unique passwords is essential.

Another critical measure in enhancing security is enabling two-factor authentication (2FA) across all cryptocurrency-related accounts. By adding this extra layer of protection, users significantly reduce the risk of unauthorized access even if their password is compromised. When 2FA is engaged, any login attempt will require not only the password but also a secondary verification code, typically sent to the user’s mobile device. It is recommended that users opt for an authenticator app rather than SMS for receiving codes, as this method is generally more secure.

Furthermore, keeping all software updates current is vital for avoiding vulnerabilities that could be exploited by cybercriminals. Cryptocurrency exchanges, wallets, and applications regularly release updates that enhance security features and patch any known vulnerabilities. Users should regularly check for updates and apply them promptly to maintain the integrity of their systems. Additionally, being vigilant against phishing attacks, which might come in the form of emails or websites masquerading as legitimate sources, is essential. Users should always verify URLs and double-check the legitimacy of communications before proceeding with any transactions.

Research and Verification: The Importance of Due Diligence

In the rapidly evolving landscape of cryptocurrency, thorough research and verification are pivotal when considering investment opportunities. With the prevalence of scams, conducting proper due diligence can safeguard individuals from losing their hard-earned money. To start with, investors should consult reputable websites that provide comprehensive insights into various cryptocurrencies and related projects. Resources like CoinMarketCap, CoinGecko, and established news platforms offer extensive data on market trends, coin valuations, and project developments. These websites often feature historical price charts and trading volumes, which can help assess the performance of different cryptocurrencies.

Moreover, it is essential to verify the legitimacy of the platforms and projects associated with the cryptocurrency. Investors should closely examine the whitepapers of new projects, which outline their objectives, technologies, and roadmaps. A whitepaper should be transparent, thorough, and free from vague statements. A lack of clarity or unrealistic promises can be red flags indicating potential scams.

Engagement in community forums is another excellent way to enhance your understanding and mitigate risks. Platforms such as Reddit, Telegram, and Twitter host vibrant discussions where experienced investors share insights and warn others about fraudulent activities. Asking questions and seeking advice within these communities can yield valuable information and help to uncover potential red flags.

Furthermore, examining the development team behind a cryptocurrency project is crucial. A transparent team with a proven track record in the industry tends to lend credibility to a project. Investors should look for team members’ profiles on professional networking sites like LinkedIn and assess their background and relevant experience. Engaging in thorough research and verification not only fosters informed decision-making but also enhances the overall security of investments in the volatile crypto space.

What to Do if You Encounter a Scam

Encountering a scam in the crypto space can be alarming, especially given the frequently evolving nature of online threats. If you suspect that you are being scammed, it is imperative to act swiftly and strategically. The first step should be to cease all communication with the suspected scammer. This will help safeguard your personal information from further compromise.

Next, it is crucial to report the scam. Many platforms have dedicated channels to handle fraud. For instance, reporting the scam to the cryptocurrency exchange involved can assist in preventing others from falling victim. Moreover, local and international law enforcement agencies, such as the Federal Trade Commission (FTC) in the United States, can provide valuable resources. Filing a complaint with them can help in tracking and potentially apprehending scammers.

Additionally, if you have shared any sensitive information, take immediate steps to protect your identity. Change your passwords across all online accounts, particularly for financial services. Consider enabling two-factor authentication for an added layer of security. Monitoring your financial statements and credit reports can help in identifying any unauthorized transactions or potential identity theft.

In some instances, seeking legal assistance might be necessary. A lawyer specializing in cybersecurity or financial fraud can provide clarity on your rights and options moving forward. They may also guide you in potential recovery of lost funds or pursuing any legal action against the perpetrators.

Ultimately, remaining vigilant and proactive is key in combating online scams in the cryptocurrency realm. By taking immediate action, you not only protect yourself but also contribute to a broader effort in curbing these illicit activities.

Staying Informed: Resources for Crypto Users

In the rapidly evolving landscape of cryptocurrency, staying informed is crucial to avoid falling victim to scams. Numerous resources are available that provide insights into secure practices and updates on potential threats in the crypto space. These resources can assist users in making informed decisions regarding their investments and understanding the associated risks.

Online forums such as Reddit offer vibrant discussion communities where crypto enthusiasts share warnings about potential scams. Subreddits like r/cryptocurrency or r/Bitcoin provide real-time information as users report their experiences with scams or fraudulent schemes. Additionally, participating in these forums allows individuals to ask questions and gain insights from experienced users.

Furthermore, dedicated websites and knowledge bases such as CoinDesk and CoinTelegraph frequently publish articles and reports on the latest scams and security practices. These platforms are reliable sources for crypto news and can help users stay ahead of fraudulent activities by keeping them informed about ongoing issues and vulnerabilities within the ecosystem.

Social media channels, particularly Twitter and Telegram, can also be valuable resources. Many crypto experts, journalists, and influential figures in blockchain regularly post updates and advice to their followers. Following reputable accounts can facilitate access to timely information related to scams and best practices. Additionally, various dedicated Telegram groups focus on educating investors about safety measures and real-time alerts about suspicious activities.

Utilizing these resources collectively can significantly reduce risks associated with cryptocurrency investments. By actively engaging with online communities, reading reputable news sources, and following trustworthy social media channels, users can build a well-rounded understanding of the crypto space and fortify themselves against common online scams.

Conclusion: Empowering Yourself Against Scams

The cryptocurrency landscape is continuously evolving, presenting both opportunities and risks for investors and enthusiasts. As the popularity of digital currencies grows, so does the potential for online scams. To protect oneself effectively, it is crucial to remain informed and proactive. Understanding the various types of scams prevalent in the crypto space, including phishing, Ponzi schemes, and impersonation scams, is the first step towards safeguarding your assets.

Moreover, staying updated on the latest developments in cryptocurrency regulations and technology can help mitigate risks. Engaging with reputable sources of information, participating in forums, and joining community discussions can enhance your awareness and knowledge. Sharing experiences and insights with others in the cryptocurrency community fosters a vigilant environment, where individuals can learn from each other’s encounters and mistakes. This collective wisdom serves as a powerful tool in combating the tactics employed by scammers.

Furthermore, encouraging others to conduct thorough research before engaging with new platforms or investment opportunities significantly decreases the likelihood of falling victim to scams. Empowering yourself, and those around you, with knowledge is essential in countering the ever-evolving methods utilized by cybercriminals. By actively participating in the crypto community and disseminating valuable information, we can establish a more secure environment for everyone involved in cryptocurrency transactions.

In conclusion, the fight against cryptocurrency scams demands continuous effort from all actors within the community. By equipping yourself with the right tools and knowledge and promoting awareness among peers, you can contribute to a safer crypto ecosystem for all.