Introduction to Part-Time Landlording

Part-time landlording is a growing trend in today’s real estate market, where individuals choose to rent out properties on a part-time basis rather than engaging in full-time property management. This approach allows property owners to generate passive income while retaining their primary occupations or other commitments. Unlike full-time landlords, part-time landlords often manage their rental properties alongside other professional pursuits, leveraging their free time to handle property-related obligations.

The concept of part-time landlording encompasses various scenarios, ranging from individuals renting out a room in their home, to those who own multiple rental units yet prefer a more hands-off management style. As urban areas become increasingly competitive and the demand for rental properties rises, many homeowners are recognizing the potential benefits of capitalizing on their assets in a part-time capacity.

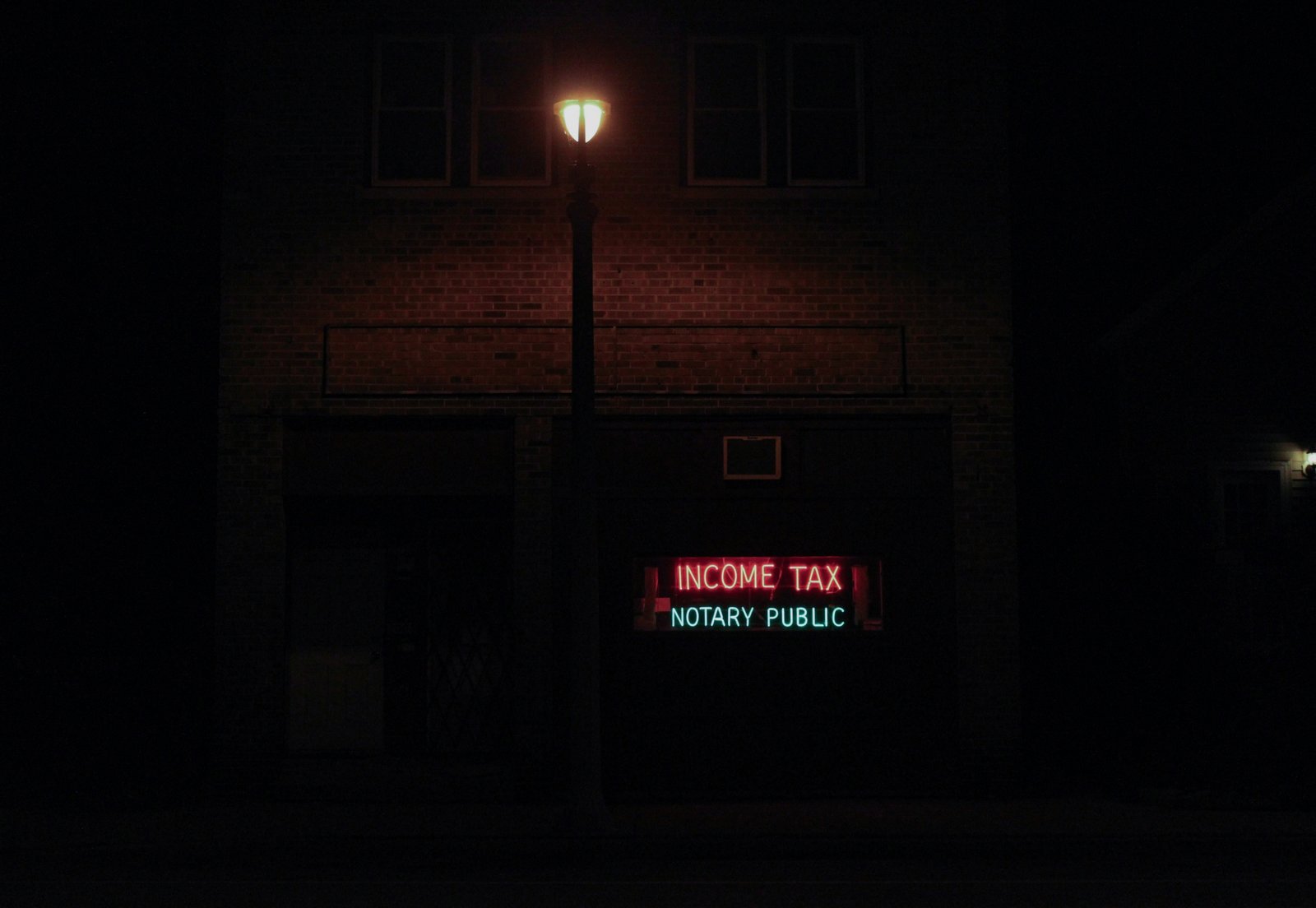

In addition to generating extra income, part-time landlording provides property owners with flexibility and the opportunity to develop their real estate management skills. However, while the benefits are notable, it is essential for part-time landlords to understand the tax implications associated with their rental activities. The tax landscape for property rental can be complex, and different jurisdictions may impose varying regulations and requirements. Therefore, staying informed and knowledgeable about these tax consequences is crucial for maximizing income and ensuring compliance.

Through a careful balance of commitment and resource management, part-time landlording can be a rewarding endeavor, both financially and personally. This blog post aims to delve deeper into the various tax benefits associated with this form of property management, providing valuable insights for those considering participating in the rental market.

Understanding Tax Deductions for Landlords

One of the primary benefits of being a part-time landlord is the array of tax deductions available, which can significantly reduce taxable income. Understanding these specific deductions is crucial for maximizing financial benefits. Common expenses that landlords may deduct include mortgage interest, property taxes, insurance premiums, and maintenance costs. Each of these deductions serves to offset rental income, ultimately minimizing the tax burden on the property owner.

Mortgage interest is typically one of the most substantial deductions for landlords. Since rental properties often involve substantial financing, the interest paid on loans can be deducted from rental income. This deduction can lead to significant tax savings, especially in the early years of a mortgage when interest payments are higher.

Another deductive expense is property taxes. Property owners are required to pay various local taxes, and these can be fully deductible. It is important for landlords to maintain accurate records of property tax payments as this will facilitate claiming the full deduction during tax season.

Landlords may also deduct costs associated with repairs and maintenance on the property. This can include anything from replacing a broken boiler to paint touch-ups. However, it is essential to distinguish between repairs, which are deductible, and improvements, which may need to be capitalized and depreciated over longer periods. Understanding this differentiation can optimize tax savings.

Additionally, expenses related to property management, such as advertising for tenants or hiring a property manager, can also be deducted. Overall, being aware of and properly documenting various deductible expenses can have a substantial impact on the taxable income of part-time landlords, enhancing the financial viability of rental property investments.

Depreciation: A Key Advantage

Depreciation is an essential concept in accounting, especially for property owners who engage in renting out their properties. In tax terms, depreciation refers to the gradual reduction in value of a tangible asset over time, primarily due to wear and tear. For part-time landlords, understanding depreciation can reveal significant tax benefits. Unlike ordinary expenses, depreciation can help lower taxable income by allowing landlords to consider the declining value of their rental property.

When it comes to rental properties, the IRS allows landlords to depreciate the cost of the property over a period of time, typically 27.5 years for residential properties. This means that a portion of the property’s purchase price can be deducted as an expense each year. To calculate depreciation, landlords determine the cost basis of the property, which includes the purchase price along with any capital improvements made. From there, this total is divided by the 27.5-year recovery period, providing a clear annual deduction. This form of tax relief is particularly advantageous since it does not require the landlord to spend any additional money out of pocket.

One notable benefit of depreciation is that it can offset income generated by the rental property. As a result, a landlord may find themselves in a lower tax bracket, paying less overall in taxes. Moreover, the depreciation deduction is a non-cash expense; therefore, it does not affect actual cash flow. Landlords can still benefit from rental income while enjoying the tax advantages that come from declaring depreciation.

In summary, the concept of property depreciation offers part-time landlords a strategic method to reduce taxable income, align expenses with earnings, and ultimately maximize their financial returns from rental activities. As such, it is an important area to consider when navigating the landscape of rental investments.

Home Office Deductions

For part-time landlords managing their rental properties from home, claiming a home office deduction can provide significant financial relief. Home office deductions allow landlords to claim a portion of their home expenses based on the area designated for business use. To qualify for this deduction, landlords must ensure that the space is used regularly and exclusively for rental property management activities.

Eligibility for the home office deduction comes down to a few key criteria. First, landlords need to have a specific area of their home set aside for managing rental properties, which can include a separate room or a defined workspace within a larger area. This workspace must not be used for any other purpose, thus maintaining the exclusive use requirement. Additionally, the office should be a principal place of business, implying that it is used substantially for rental management tasks, such as handling tenant inquiries or maintaining property records.

To calculate the home office deduction, landlords can typically choose between two methods: the simplified option or the regular method. The simplified option allows for a standard deduction of $5 per square foot of home office space, up to a maximum of 300 square feet, resulting in a potential deduction of $1,500. Conversely, the regular method requires landlords to calculate actual expenses, including a proportionate share of utilities, repairs, and mortgage interest based on the percentage of the home that the office occupies.

However, there are potential pitfalls to consider. Maintaining clear records is crucial, as improper documentation can lead to disallowed deductions. Furthermore, claiming a home office deduction may impact capital gains tax calculations when selling the property, as the portion of the home used for business can alter tax liabilities. It is advisable to consult a tax professional to navigate these complexities effectively.

Travel Expenses and Management Costs

When it comes to being a part-time landlord, understanding the tax implications surrounding travel expenses associated with your rental properties is crucial. Such expenses can form a significant portion of the deductions available to landlords. For instance, travel to your rental property for management purposes can be deducted as a business expense on your tax return. This can include visits for property maintenance, tenant relations, or conducting necessary inspections.

It is important to keep detailed records of all travel-related expenses incurred in relation to your rental property. This may encompass mileage if you use your personal vehicle, public transportation costs, meals while conducting business, and lodging if you need to stay overnight. However, be mindful that only the portion of the trip directly related to managing your rental property can be claimed as a deduction. Thus, separating personal travel from business trips is essential for accurate tax filings.

Additionally, if the management of your rental property is delegated to a property management company, the costs associated with such services are typically deductible as well. These expenses might include management fees, advertising for tenants, or screening applicants. By categorizing these operational expenses accurately, part-time landlords can potentially reduce their overall taxable income.

It’s also advisable to consult with a tax professional to comprehend fully how travel expenses and management costs can factor into your overall tax situation, ensuring compliance with current tax regulations while maximizing deductions you may qualify for as a part-time landlord. Keeping abreast of changes in the tax laws in your jurisdiction regarding rental income and associated expenses is also prudent to take advantage of all available tax benefits.

Impact of Local and State Taxes

The tax obligations faced by part-time landlords can significantly vary depending on local and state tax laws. Understanding these nuances is crucial for landlords aiming to optimize their tax liabilities. In some regions, local governments provide tax incentives aimed at encouraging property rentals, which can be a formidable financial advantage for landlords.

For example, numerous states offer property tax exemptions for rental properties, particularly if they are classified as low-income housing. A part-time landlord operating in such a state may benefit significantly from reduced property taxes. This exemption can free up cash flow that landlords can utilize for property maintenance or reinvestment purposes. Moreover, certain states have enacted tax credits specifically aimed at landlords who provide affordable housing, further enhancing the appeal of becoming a part-time property owner.

Additionally, the deductibility of expenses is a critical factor. Many local tax codes allow landlords to write off expenses related to property management, maintenance, and improvements, as well as property-related taxes. Such allowances can vary widely, emphasizing the need for landlords to familiarize themselves with their locality’s tax regulations. Examples of deductible expenses can include repairs, insurance, and mortgage interest, which can supplement the landlord’s net rental income. Moreover, some local jurisdictions have implemented specific tax breaks to stimulate the rental market, like temporary tax reductions for newly acquired rental properties.

Ultimately, part-time landlords should consider consulting with a tax professional who can provide tailored advice based on their specific situation and location. Understanding local and state tax obligations will help landlords make informed financial decisions, thus making their rental ventures more profitable.

Evaluating the Tax Bracket Effect

Becoming a part-time landlord has the potential to supplement one’s income, but it also introduces a new source of taxable earnings. Understanding how rental income impacts your tax bracket is crucial for effective tax planning. When you earn rental income, it is added to your total annual income, which can elevate your overall taxable earnings and lead to a higher tax bracket. This increased income means that a portion of your earnings will be taxed at a higher rate, thereby reducing your net rental profit.

For example, if your regular annual income places you in a lower tax bracket, the rental income you generate may push you into a higher tax bracket. Consequently, this could result in a significant tax liability. It is essential to evaluate your financial situation thoroughly and anticipate the tax implications before delving into rental property investment.

However, several strategies can be employed to mitigate the increase in tax liability resulting from additional income. Deductions associated with rental properties, such as mortgage interest, property management fees, and repair costs, can be claimed to offset rental income. Depreciation is another essential factor; it allows landlords to deduct a percentage of the property’s value over time, which can substantially reduce taxable income.

Moreover, if the rental property is categorized as a passive activity, which many are, it may offer limited advantages in offsetting income against losses. It is advisable for landlords to track all expenses meticulously to ensure they maximize deductions. Engaging with a tax consultant can provide more personalized insights into your tax situation and help devise a strategy tailored to your circumstances.

Tax Considerations When Selling a Rental Property

When a part-time landlord decides to sell a rental property, understanding the tax implications is crucial to maximizing financial returns. One of the primary tax considerations is capital gains tax, which is levied on the profit from the sale of the property. This tax applies to the difference between the selling price and the property’s adjusted basis, which includes the purchase price plus any substantial renovations made over the ownership period.

The capital gains tax rate varies depending on how long the property has been owned. If the property is held for more than one year, it typically qualifies for long-term capital gains rates, which are significantly lower than short-term rates that apply to properties sold within a year of acquisition. Therefore, holding onto a rental property for a longer period can yield substantial tax savings for landlords.

Additionally, landlords should explore the possibility of a 1031 exchange, which allows for the deferral of capital gains tax if the sale proceeds are reinvested in a like-kind property. This option can be particularly advantageous for part-time landlords looking to upgrade or change their real estate investments without incurring immediate tax liabilities. To qualify, the exchange must meet specific guidelines, including strict timelines for identifying and purchasing replacement properties.

It is essential for landlords to maintain accurate records of all relevant transaction details to adequately support their tax positions. This includes documentation of the purchase price, improvement costs, and any other expenses that can impact the property’s basis. By staying informed and seeking professional advice, part-time landlords can effectively manage the tax considerations associated with selling their rental properties, thereby maximizing their financial advantages.

Conclusion: Weighing the Pros and Cons

Becoming a part-time landlord can offer various tax benefits, making it an appealing opportunity for individuals looking to supplement their income. The ability to deduct expenses such as mortgage interest, property taxes, repairs, and management fees can significantly offset rental income, potentially reducing overall taxable income. Additionally, part-time landlords can also benefit from depreciation, which serves to lower taxable earnings over time. These tax advantages make the pursuit of owning rental property attractive for many.

However, the role of a part-time landlord does not come without its challenges. Managing a rental property can require significant time and effort, especially if unexpected issues arise, such as repairs or tenant disputes. Furthermore, the responsibilities of ensuring compliance with local housing regulations and maintaining property quality can also become burdensome. One must also consider the financial risks involved, including potential vacancy periods that could lead to decreased cash flow.

It is essential to thoroughly evaluate these factors when considering the lifestyle and commitments associated with part-time landlording. For some, the financial and tax benefits may outweigh the inconveniences and responsibilities tied to managing a rental property. For others, the challenges may prove to be more daunting than expected. Ultimately, prospective part-time landlords are encouraged to carefully analyze their unique circumstances and perform due diligence in assessing whether the benefits of this venture align with their personal and financial goals.