Introduction

Managing finances can be a complex endeavor for couples, particularly when each partner maintains separate accounts. This situation often leads to challenges in financial transparency and open communication regarding shared and individual expenditures. Without a unified approach to handling finances, couples may find themselves facing misunderstandings or difficulties in meeting their financial goals.

Budgeting entails much more than simply tracking what one spends; it serves as the foundation for discussions about priorities, spending habits, and long-term financial aspirations for couples. This is especially true for couples with separate accounts, as each partner must actively work to align their financial decisions with shared objectives. Transparency becomes essential to successfully navigating this landscape.

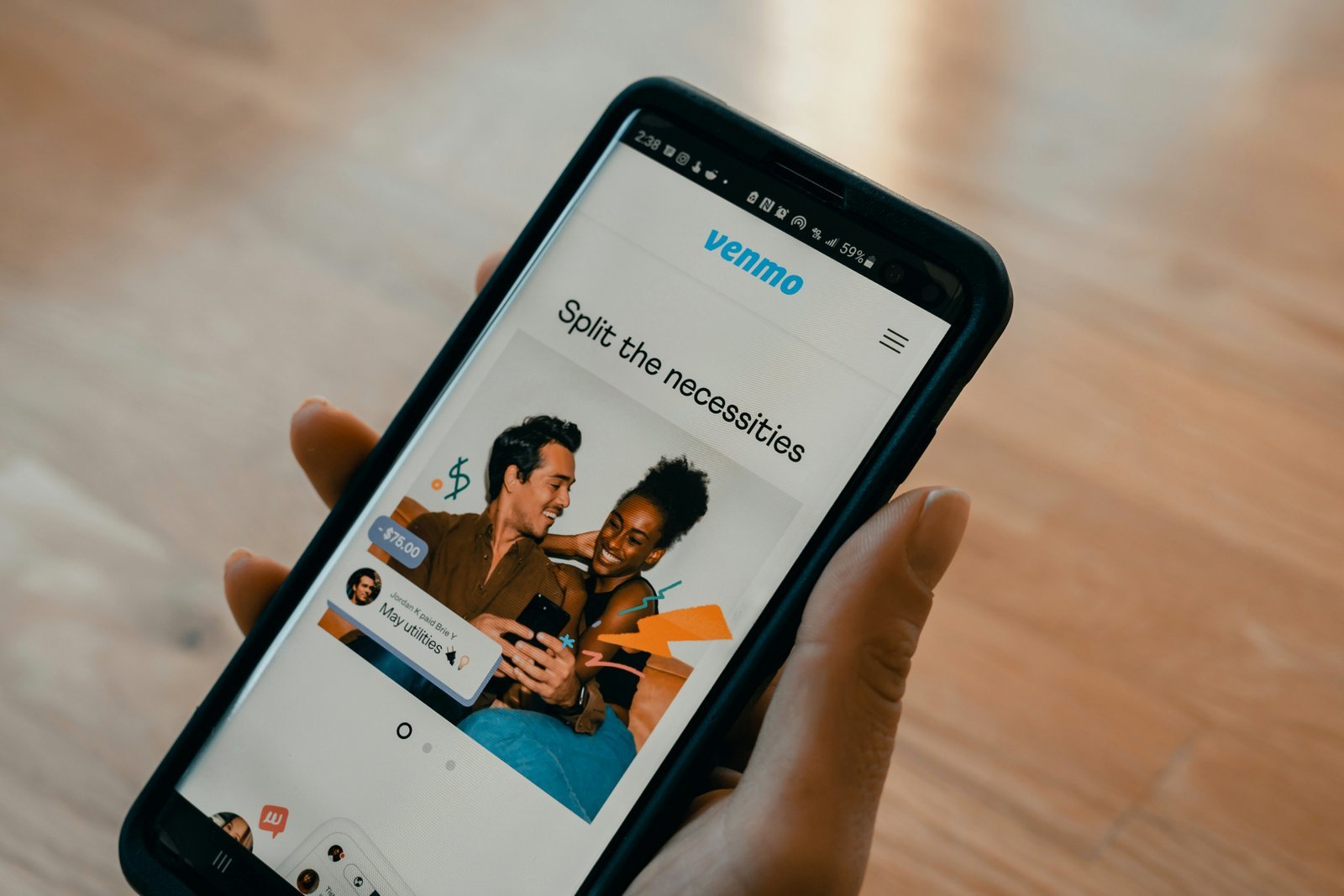

To aid couples in achieving effective budgeting, numerous budgeting apps specifically designed for dual-account management have emerged. These applications facilitate the tracking of shared expenses while allowing each partner to maintain their financial independence. By doing so, couples can engage in more constructive financial dialogues and foster a collaborative approach to managing their household finances.

Considering the importance of financial stability and common goals, selecting the right budgeting app is a crucial step for couples without joint accounts. Not only do these tools optimize budgeting practices, but they also enhance communication around money matters. Therefore, integrating technology into personal finance management can greatly contribute to a couple’s financial health.

In this post, we will explore some of the best budgeting apps available to help couples manage their finances effectively, ensuring both shared and individual expenses are accounted for seamlessly.

Why Budgeting is Essential for Couples

Budgeting plays a crucial role in fostering a harmonious financial relationship between couples. It serves as a foundation for establishing clear financial goals, which can effectively reduce financial stress and conflict. Financial disagreements are one of the leading causes of tension in relationships. By implementing a well-structured budgeting system, couples can alleviate the anxiety that often accompanies monetary decisions and enhance their overall satisfaction with their financial situation.

An essential aspect of budgeting is that it fosters improved communication about money. When both partners engage in budgeting discussions, they become more aware of each other’s financial priorities and concerns. This understanding can lead to more open and honest dialogues about spending habits and monetary contributions, thus avoiding misunderstandings or surprises. For couples managing separate accounts, a budgeting app can facilitate this dialogue by providing a shared platform to track expenses and income, ensuring both partners are on the same page.

Another important benefit of budgeting is the alignment of financial goals. Each partner may have individual aspirations, such as saving for a vacation, buying a home, or investing for retirement. A budget makes it possible to prioritize these goals collectively, helping couples build a future together while remaining aware of their individual needs. Furthermore, without a budgeting system in place, couples often encounter common pitfalls such as overspending, accumulating debt, and mismanaging funds, which can strain the relationship. By prioritizing budgeting as a couple—with tools that accommodate their separate accounts—they can navigate finances more effectively and with increased confidence.

Criteria for Choosing Budgeting Apps

When selecting the best budgeting apps for couples who maintain separate accounts, several key criteria must be taken into account. The suitability of a budgeting app can significantly influence its effectiveness in managing finances collaboratively.

First and foremost, ease of use is paramount. A budgeting app should feature an intuitive interface that can facilitate regular use by both partners without requiring extensive financial knowledge. Users should not feel overwhelmed by technical jargon or complex navigation. A simplified process ensures that both individuals can regularly update and review their spending, which is crucial for effective budget management.

Compatibility with separate banking accounts is another essential factor. The best budgeting apps allow users to link multiple bank accounts seamlessly, enabling couples to monitor their individual expenses while still having a holistic view of their shared financial goals. This functionality is vital for promoting transparency in spending habits and for joint financial planning.

Additionally, features that enable the tracking of shared expenses are crucial for couples looking to maintain financial harmony. Apps that allow users to categorize expenses, split bills, and even set joint financial goals can significantly enhance the budgeting experience. These features help ensure that both partners are on the same page regarding their financial commitments and shared expenditures.

Security measures should also be a major consideration. Couples must feel confident that their financial data is protected against unauthorized access. Look for apps that employ robust encryption, secure authentication, and a solid privacy policy to safeguard users’ information.

Lastly, mobile accessibility can greatly influence the suitability of a budgeting app. As many individuals prefer managing their finances on the go, applications that offer well-designed mobile interfaces provide an added advantage. Being able to access budgeting tools from any location can instill a discipline in managing finances regularly.

Top Budgeting Apps for Couples

Managing finances in a relationship can be challenging, especially for couples who maintain separate accounts. Fortunately, several budgeting apps cater specifically to couples, offering features that facilitate shared financial management. Below, we explore some of the top options available.

1. YNAB (You Need a Budget)

YNAB is designed to help users allocate every dollar they earn, promoting proactive budgeting. Its key features include goal tracking, real-time budgeting, and compatibility with multiple financial accounts. YNAB strongly emphasizes education, offering resources to help users understand budgeting principles. The downside is its subscription fee, which some couples may find restrictive, but the comprehensive tools provided often justify the cost.

2. Honeydue

Honeydue is tailored for couples, allowing them to track their finances collaboratively. Couples can link their individual bank accounts, monitor bills, and set financial goals together. The app also includes reminders for upcoming bills and deadlines. While Honeydue is free, some users have reported occasional technical glitches, which can be a minor inconvenience.

3. Mint

Mint is a popular budgeting app for individuals and couples alike. It automatically organizes transactions and offers personalized budgeting recommendations. The strengths of Mint lie in its intuitive interface and robust reporting features, enabling couples to visualize their spending habits. However, users sometimes encounter ads, which may detract from the experience.

4. GoodBudget

GoodBudget utilizes the envelope budgeting method, allowing couples to allocate portions of their income toward different spending categories. It also supports syncing between devices, making it easy for both partners to access and manage the budget in real-time. The downside is that some features are limited to the paid version, which may not appeal to all couples.

Each of these apps offers unique advantages and challenges, catering to the diverse financial needs of couples with separate accounts. Selecting the right budgeting app can enhance communication and transparency in managing shared finances.

How to Use Budgeting Apps Effectively as a Couple

When couples maintain separate financial accounts, using budgeting apps can significantly streamline their financial management. One of the first steps couples should take is to set shared financial goals. This includes discussing long-term objectives such as saving for a house, planning a vacation, or establishing an emergency fund. By defining these goals together, both partners can align their budgeting efforts with their shared aspirations, utilizing the budgeting app to track progress towards these targets.

Regular check-ins are essential for effective collaboration. Couples should schedule weekly or monthly meetings to discuss expenses and make necessary budget adjustments. This practice fosters open communication about finances, allowing each partner to express concerns or suggest modifications based on their individual spending habits. During these discussions, partners can also review any discrepancies in spending and evaluate how well they are adhering to their financial plan. This ongoing dialogue not only strengthens the partnership but also helps in mitigating misunderstandings related to money.

Creating a budgeting routine that accommodates both partners’ spending habits is crucial. Couples must recognize that they may have differing financial priorities and habits, and budgeting apps can help respect these differences. One effective strategy is to designate specific budget categories for each person based on individual preferences, alongside shared categories for joint expenses. This method allows both partners the freedom to spend within their limits, reducing potential conflicts while still focusing on collective goals.

By leveraging these methods, couples can maximize the functionality of budgeting apps. The emphasis should always remain on collaboration, communication, and respect for each other’s financial choices. This balanced approach ultimately enhances financial stability while nurturing the relationship over shared financial goals.

Potential Challenges and Solutions

Budgeting apps can significantly enhance the financial planning process for couples, especially those with separate accounts. However, several challenges may arise during their implementation and ongoing use. Understanding these potential issues is essential for smoother financial management in a relationship.

One common challenge couples face is differing spending habits. Individuals often approach money with distinct philosophies, leading to friction regarding budget allocations and spending limits. For instance, one partner may prioritize savings for future investments, while the other may prefer enjoying immediate experiences. To tackle this issue, couples should engage in open conversations about their financial goals and spending philosophies. A joint budgeting session where both parties can voice their opinions can ensure that the budget reflects shared values while accommodating individual spending preferences.

Another significant hurdle is the lack of communication regarding financial matters. Couples may struggle to keep each other informed about their personal budgeting and spending, which can inadvertently create misunderstandings or mistrust. Establishing regular check-ins can be a practical solution. Scheduling monthly reviews of spending patterns and budget adherence will provide a platform for dialogue. This practice can strengthen the couple’s financial intimacy and accountability.

Lastly, the initial learning curve associated with new technologies can be formidable. Some budgeting apps may have complex interfaces that can overwhelm users unfamiliar with digital finance tools. To mitigate this challenge, couples should consider choosing apps known for user-friendly designs. Utilizing instructional resources, such as tutorials or forums, can enhance their confidence and proficiency in utilizing these budgeting tools effectively.

Success Stories from Couples Using Budgeting Apps

Many couples today face challenges in managing their finances together, especially when they maintain separate accounts. However, numerous success stories from couples utilizing budgeting apps demonstrate that these tools can significantly improve financial planning and communication.

For example, Emma and Jack, a young couple living in Seattle, struggled with differing spending habits. Emma preferred a conservative approach, while Jack enjoyed spontaneous purchases. After they started using a budgeting app, they were able to set shared goals and track their expenses in real-time. By jointly establishing a budget, they not only ensured that their essential needs were met but also allocated funds for leisure activities they both enjoyed. This tool fostered open discussions about finances and ultimately strengthened their relationship.

Another inspiring story comes from Sarah and Tom, who had difficulties planning their wedding due to financial disagreements. They decided to explore a budgeting app which allowed them to work collaboratively on a shared wedding budget. The app provided insights into their spending patterns, and they quickly realized how much they could save by adjusting a few lifestyle choices. As a result, they successfully planned their dream wedding without incurring debts, and the process helped them communicate more openly about money management.

Similarly, Lisa and Kevin, parents of two young children, utilized a budgeting app to manage their household expenses. They discovered that by tracking their spending collectively, they could allocate resources better for both childcare and savings for future educational needs. Not only did they achieve their financial goals, but they also developed a newfound appreciation for each other’s financial perspectives.

These testimonials from couples illustrate that budgeting apps can support shared financial objectives. By facilitating better communication and cooperation, these applications have proven invaluable in strengthening partnerships while achieving their financial aspirations.

Expert Advice on Financial Management for Couples

Managing finances as a couple can be both rewarding and challenging, particularly when each partner maintains separate accounts. A proactive approach to financial discussions is crucial for building transparency and trust. Experts recommend scheduling regular money meetings where both partners can openly discuss their financial situations, goals, and any concerns. This dialogue creates a safe space for both individuals to express their thoughts while aligning their financial priorities.

One effective strategy is to implement a budgeting framework that accommodates both individual and joint expenses. Couples should first outline their mandatory costs, such as rent or mortgage, utilities, and groceries. Then, discussing discretionary spending becomes easier, allowing each partner to understand where they can compromise and allocate funds effectively. This method establishes a balanced approach and encourages mutual respect for each other’s financial habits.

Setting long-term financial goals is another vital component for successful financial management. Experts suggest working together to define common aspirations, such as saving for a home, vacations, or retirement. By identifying and visualizing these goals, couples can work collaboratively toward achieving them, which strengthens teamwork and communication. Additionally, each partner should also be encouraged to have personal financial goals, fostering individual accountability.

Regular financial check-ins also play a significant role in maintaining harmony in managing finances. These sessions should cover progress towards established goals, changes in income, or new financial obstacles. Addressing issues promptly can prevent misunderstandings and ensure that both partners remain on the same financial wavelength. By prioritizing open communication, shared objectives, and regular reviews, couples can navigate their respective financial landscapes effectively while nurturing their relationship.

Conclusion and Next Steps

In today’s fast-paced world, effective financial management is essential, especially for couples who maintain separate accounts. Budgeting apps designed for couples can significantly enhance transparency, streamline communication about finances, and facilitate a shared understanding of financial goals. By employing the right tools, partners can work together on their budgeting journey, which encourages cooperation and reduces potential conflicts over money management.

Utilizing budgeting apps allows couples to track expenditures, set shared savings goals, and monitor their progress in real time. This approach not only fosters accountability but also promotes a sense of teamwork, vital for maintaining a healthy financial relationship. Couples can benefit from features such as synchronized budgets, expense tracking, and various reporting functions which help in visualizing financial data, making it easier to plan for future expenses.

As you consider the best budgeting strategy for your partnership, it’s advisable to explore the different applications available that cater specifically to couples. Start by discussing individual financial habits and goals, and then choose a budgeting app that aligns with your collective needs. Look for user-friendly interfaces and features that will make managing your finances engaging rather than burdensome.

As the next step, couples should set aside time to regularly review their budgets, celebrate milestones achieved, and make necessary adjustments along the way. This practice will not only solidify financial discipline but also nurture the bond between partners through shared responsibility. Embracing a budgeting app may just be the key to financial harmony in your relationship, providing a pathway to achieve short-term and long-term financial aspirations together.