Introduction to Bitcoin and Its Relevance in 2026

Bitcoin, the pioneering cryptocurrency, was introduced to the world in 2009 by an anonymous entity known as Satoshi Nakamoto. It emerged as a revolutionary digital currency that operates on a decentralized ledger called the blockchain, allowing peer-to-peer transactions without the need for intermediaries. Over the years, Bitcoin gained traction as not just a medium of exchange but also as a store of value, often referred to as “digital gold.” By 2026, Bitcoin’s relevance has escalated, reflecting its profound impact on the global financial landscape.

In recent years, the cryptocurrency market has expanded significantly, drawing not only tech-savvy individuals but also institutional investors, governments, and multinational corporations looking to harness the potential of blockchain technology. Bitcoin, as a digital asset, has evolved to become a key player in diversifying investment portfolios and mitigating inflation risks. Its finite supply, capped at 21 million coins, ensures that it remains an attractive option for those looking to hedge against traditional monetary policies.

The significance of Bitcoin extends beyond investment; it has transcended into a global method of transaction. As of 2026, an increasing number of merchants and service providers accept Bitcoin as a means of payment, reinforcing its utility as a currency. Countries facing economic instability have also adopted Bitcoin and other cryptocurrencies, enabling citizens to preserve their wealth amidst currency devaluation and restrictions on capital flow. This growing acceptance mirrors a shift in public perception, as more individuals acknowledge cryptocurrencies as a legitimate financial tool.

With this evolving landscape, the act of buying Bitcoin has become an appealing consideration for individuals seeking to enter the world of cryptocurrencies. Understanding its historical context and current relevance is crucial for anyone contemplating their first investment in Bitcoin. The future continues to look promising for this digital asset, making it an opportune time to consider how to safely acquire your first $100 of Bitcoin.

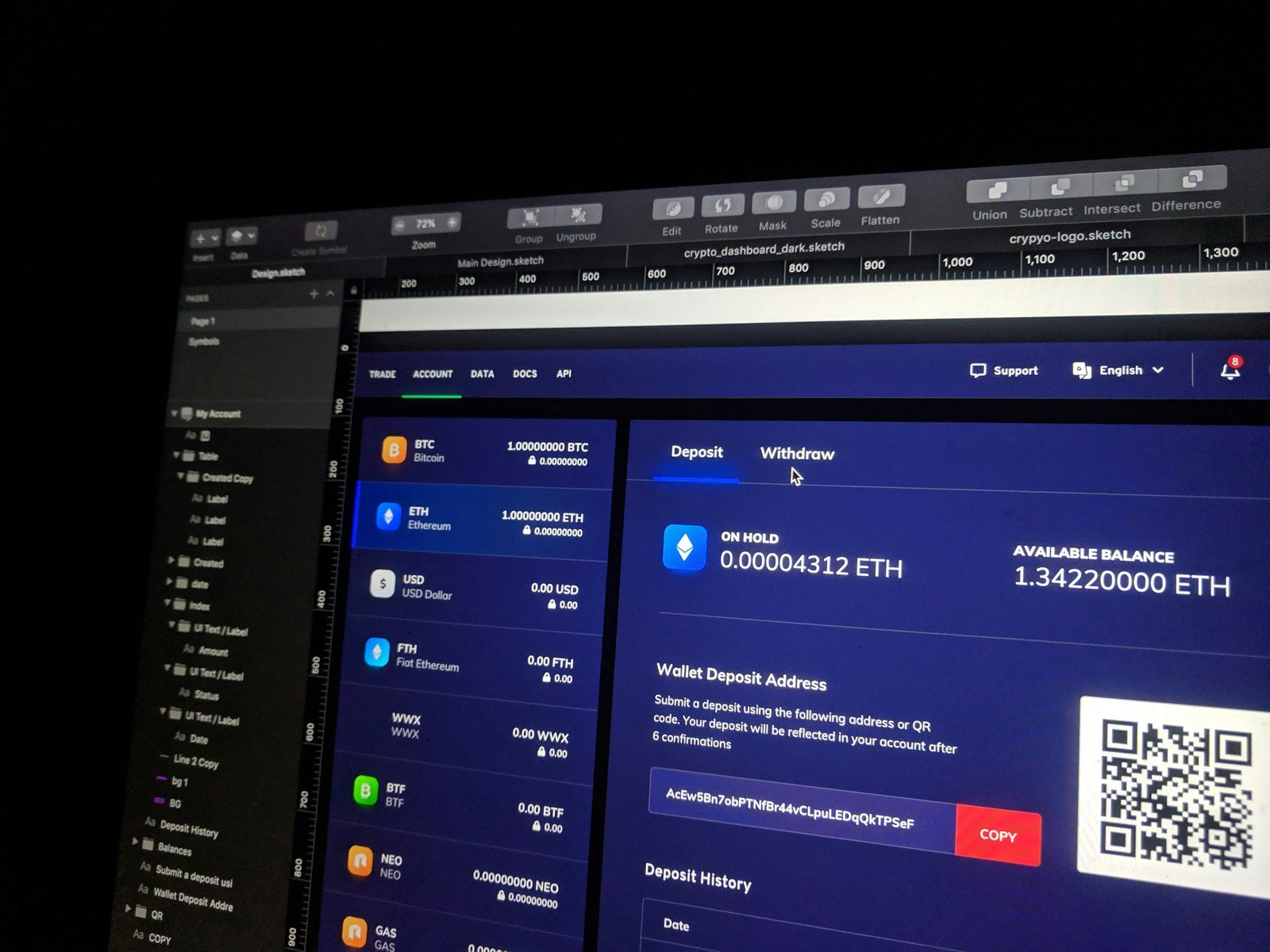

Understanding Cryptocurrency Wallets: A Beginner’s Guide

Cryptocurrency wallets play a crucial role in the management and security of Bitcoin and other digital assets. A cryptocurrency wallet is essentially a digital tool that allows users to store, send, and receive their cryptocurrencies. These wallets do not store the actual coins but rather hold the cryptographic keys that grant access to the blockchain where the cryptocurrencies exist.

There are several types of cryptocurrency wallets, each catering to different needs and preferences. One of the primary types is the hardware wallet. Hardware wallets are physical devices that securely store your private keys offline. Because they are not connected to the internet, they significantly reduce the risk of hacking. Popular options include Ledger and Trezor, which are known for their robust security features.

The next type is the software wallet, which can be accessed via desktop, mobile, or web applications. These wallets provide a balance between convenience and security, as they are more user-friendly for beginners. Examples include Exodus and Trust Wallet, which offer a straightforward interface and integrate various features such as exchanging cryptocurrencies directly within the wallet.

Paper wallets are another option, which involves printing your cryptocurrency’s private and public keys on a physical piece of paper. While they offer a high level of security against hacking, they are vulnerable to physical damage or loss, making careful handling essential.

When selecting a wallet, beginners should prioritize security features such as two-factor authentication, backup options, and the ability to hold multiple cryptocurrencies. It is also wise to consider the reputation of the wallet provider and user reviews to ensure reliability and support. Understanding these aspects of cryptocurrency wallets is vital to safely managing one’s Bitcoin investments and minimizing potential risks associated with digital currencies.

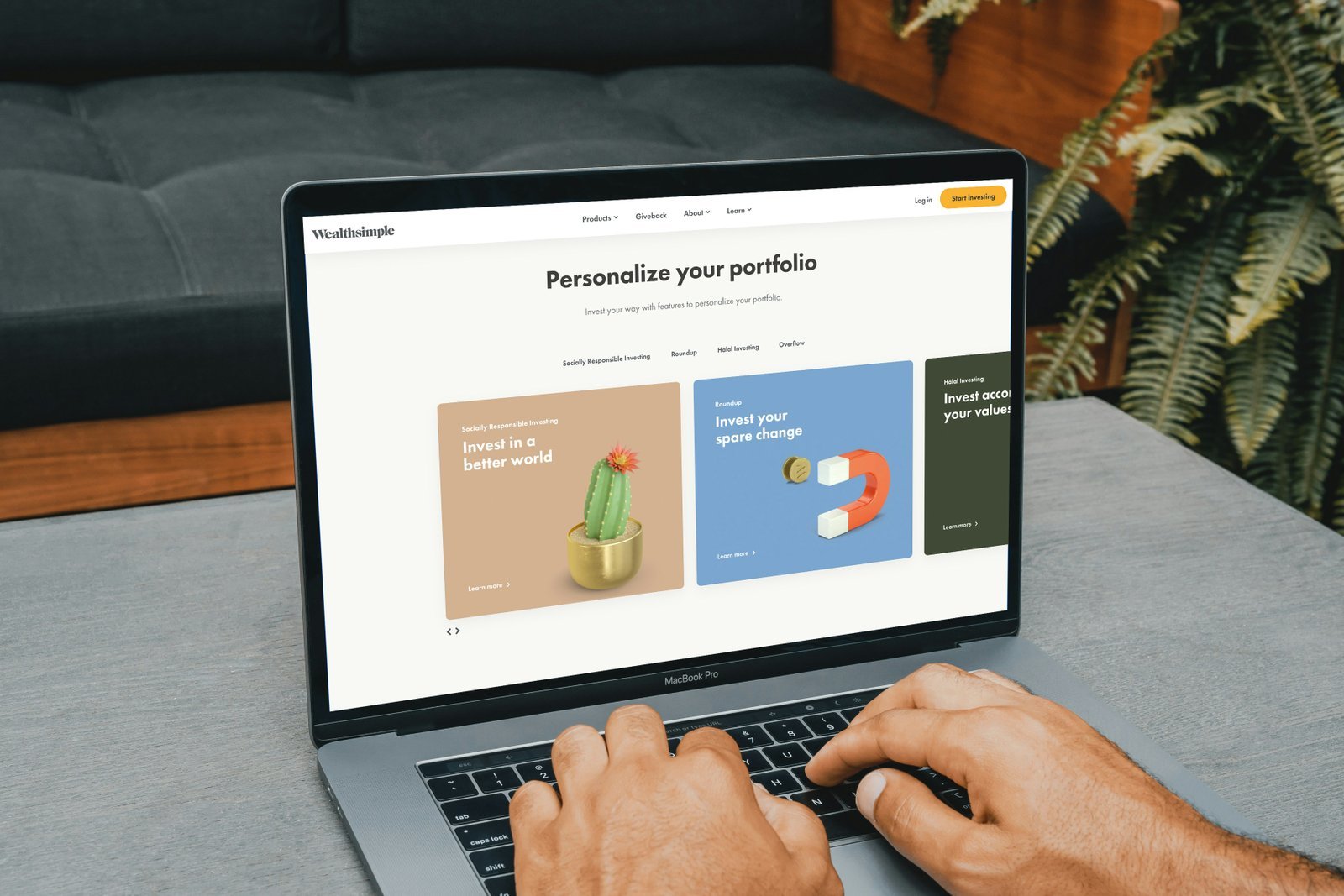

Selecting a Trustworthy Exchange for Your Purchase

When embarking on the journey of purchasing Bitcoin, especially for the first time, selecting a reputable cryptocurrency exchange is paramount. The landscape of exchanges continues to evolve, and in 2026, several key factors should be on the minds of prospective buyers.

Firstly, security should be the foremost consideration. A trustworthy exchange must implement robust security protocols, including two-factor authentication, cold storage for the majority of funds, and a solid history of safeguarding user assets. Investigating the exchange’s security record can provide insights into its reliability. Additionally, checking for regulatory compliance with the relevant financial authorities can further affirm the safety of the platform.

Next, you must evaluate the fees associated with transactions. Exchanges typically charge trading fees, deposit and withdrawal fees, and, occasionally, various other costs. A thorough comparison of different exchanges will help identify one that balances low fees with the quality of service. Look for exchanges that provide transparency regarding their fee structures.

User experience cannot be overlooked either. A well-designed, intuitive platform enhances the buying process, especially for newcomers. Potential users may benefit from reading reviews or exploring demo accounts to gauge the interface’s user-friendliness and functionality.

Geographical availability is another crucial aspect. Certain exchanges may not operate in specific regions or countries due to regulatory restrictions. Confirm that the selected exchange operates in your area to prevent complications during transactions.

Reputable exchanges that have stood the test of time include Coinbase, Kraken, and Binance. Each of these exchanges has established a solid foundation in the cryptocurrency market. When verifying trustworthiness, consider examining their customer support services, user feedback, and history of operations, as these can provide further assurance of reliability.

Setting Up an Account and Verification Process

To buy your first $100 of Bitcoin safely in 2026, you must begin by setting up an account on a reliable cryptocurrency exchange. The process typically starts with selecting a reputable exchange that caters to your needs. Leading platforms include Coinbase, Binance, and Kraken. Once you have chosen an exchange, navigate to their website and find the registration page where you will begin creating your account.

The registration process will require you to provide basic personal information, such as your full name, email address, and a secure password. It is essential to choose a strong password to enhance security. Many exchanges now enforce two-factor authentication (2FA) as an important security measure. When enabled, 2FA adds an additional layer of protection by requiring a code sent to your mobile device whenever you log in.

After submitting your account details, you need to undergo the Know Your Customer (KYC) verification process, which is mandatory for most exchanges to comply with regulatory requirements. This stage often involves uploading identification documents, such as a government-issued ID or passport, along with proof of address, like a utility bill or bank statement. The verification process may take a few minutes to several days, depending on the exchange’s policies and the volume of requests they are handling.

Once your account is verified, it is vital to set up security protocols. In addition to 2FA, consider regularly updating your password and enabling withdrawal whitelist features, where you can limit withdrawal addresses to specific wallets. By following these steps and implementing these security measures, you will create a robust foundation for safely purchasing Bitcoin and managing your digital assets effectively.

How to Fund Your Exchange Account Safely

When considering how to fund your exchange account to buy Bitcoin, it is essential to choose a method that balances convenience, security, and cost. The most commonly used methods are bank transfers, credit or debit card payments, and electronic wallets.

Bank transfers are a widely accepted method for funding exchange accounts. They typically involve lower fees than other payment options but may take several days to process, depending on the bank’s policies. When using bank transfers, it is crucial to ensure that you are sending funds to the correct exchange address, to avoid potential loss of funds. Additionally, using a bank that is familiar with cryptocurrency transactions can enhance security.

Credit and debit card payments offer a swift way to fund your exchange account, allowing you to buy Bitcoin almost instantly. However, this method may come with higher fees compared to bank transfers, and not all exchanges accept card payments due to fraud concerns. It is advisable to verify whether the chosen exchange has adequate security measures in place, such as two-factor authentication (2FA), to protect your information.

Another option includes electronic wallets, such as PayPal or Skrill. These platforms can facilitate faster transactions than traditional banking methods and may offer added layers of security. However, be mindful that some exchanges have limits on the amount you can fund using an electronic wallet, and conversion fees might apply when transferring funds.

To ensure a smooth and secure funding process, always conduct thorough research on the exchange and the method you intend to use. Additionally, consider starting with small amounts to test the transaction process and familiarize yourself with the exchange’s interface. By taking these precautions, you can significantly reduce risks associated with funding your exchange account.

Executing Your First Bitcoin Purchase

Purchasing Bitcoin can be a straightforward process if you follow a systematic approach. First, you will need to choose a cryptocurrency exchange that suits your needs. Popular exchanges like Coinbase, Binance, and Kraken are generally user-friendly and trusted. Once you’ve created an account, ensure your identity is verified in compliance with Know Your Customer (KYC) regulations.

Next, you will need to deposit funds into your exchange account. This can often be done through bank transfer or credit card. Once your account is funded, you are ready to execute your first Bitcoin purchase. There are two primary types of orders you can place: a market order and a limit order. A market order buys Bitcoin at the current market price, while a limit order allows you to set a specific price at which you’re willing to buy. For your first purchase of $100 worth of Bitcoin, a market order may be the simplest choice.

When placing a market order, specify the dollar amount you wish to invest; in this case, you will enter $100. The exchange will calculate how much Bitcoin you can purchase with that amount based on current market conditions. It’s also important to consider any transaction fees the exchange may charge for the purchase. Ensure that you review these fees before finalizing your order to understand how they affect your total investment.

After placing the order, take a moment to review the transaction details and ensure everything is accurate. Confirm that you are comfortable with the purchase price and any fees involved. Once satisfied, you can finalize the transaction. Upon successful execution, you will see the Bitcoin reflected in your account balance. This foundational step will help you gain confidence in managing your cryptocurrency holdings.

Storing Your Bitcoin: Security Best Practices

Once you have purchased your first $100 of Bitcoin, the next critical step is to ensure it is stored securely. The most significant risk associated with Bitcoin is theft or loss due to security breaches. Therefore, transferring your Bitcoin from the exchange to a secure wallet is essential for safeguarding your investment. There are various types of wallets available, including hardware wallets, software wallets, and paper wallets, each with its benefits and drawbacks.

Hardware wallets are considered one of the safest options, as they store your Bitcoin offline. This means that they are less vulnerable to hacking attempts compared to online wallets hosted by exchanges. Software wallets, on the other hand, can be installed on your device and provide convenient access to your cryptocurrency. However, you should ensure that your device is free from malware and has adequate security measures in place, such as antivirus software and firewalls. Paper wallets are another security option, allowing you to print your private keys and addresses on paper, but this method requires careful handling to avoid physical loss or damage.

It’s vital to develop a backup strategy for your wallet. Regularly backing up your wallet ensures that if your device fails or gets lost, you still have access to your Bitcoin. Most wallets provide a recovery phrase—a series of words that can restore your wallet if needed. Store this phrase securely, ideally offline, and avoid sharing it with others. Additionally, be cautious of phishing attempts and always verify the authenticity of any communication regarding your Bitcoin. It’s also advisable to keep your software wallet updated to protect against vulnerabilities.

By implementing these security best practices, including choosing the right type of wallet, backing up your recovery phrases, and staying vigilant against phishing scams, you can significantly lower the risks associated with storing your Bitcoin.

Understanding Bitcoin Market Volatility and Risks

Bitcoin, as a leading cryptocurrency, is known for its notorious market volatility, which can significantly impact the investment landscape. Historical data shows that Bitcoin has experienced drastic price fluctuations, with values at times swinging by more than 10% within a single day. Such volatility can create both opportunities for profit and risks for loss, making it essential for potential investors to comprehend the dynamics at play.

The nature of Bitcoin price changes can be attributed to several factors, including market sentiment, regulatory news, technological advancements, and macroeconomic trends. For instance, positive developments in the blockchain technology space or a favorable regulatory environment may lead to price surges, while negative news, such as security breaches or government crackdowns, can cause sharp declines. Understanding these factors is critical for anyone looking to invest a small amount, such as their first $100 in Bitcoin.

Moreover, the potential for profit does exist alongside the risks involved. Investors who can navigate market highs and lows carefully often find lucrative opportunities. However, the inherent unpredictability of Bitcoin necessitates a robust risk management strategy. This strategy might include setting a budget that limits how much of one’s portfolio can be allocated to Bitcoin or implementing stop-loss orders to minimize potential losses. It is advisable that first-time investors educate themselves adequately about market trends and adopt a cautious approach when entering the Bitcoin market.

Conclusion: Your Journey into Cryptocurrency Investment

As you embark on your cryptocurrency investment journey, it is essential to recap the core aspects discussed throughout this blog post. Purchasing your first $100 of Bitcoin in 2026 is not just a step into the realm of digital assets but also a significant stride towards understanding financial landscapes influenced by technology. Throughout this guide, we examined the importance of selecting a reliable cryptocurrency exchange, ensuring your account security through robust measures, and understanding the fundamentals of Bitcoin.

The volatility in the cryptocurrency market necessitates that you approach your investments with caution and an informed mindset. By conducting thorough research, staying updated about market trends, and utilizing available resources, you can cultivate a better understanding of Bitcoin trends and function. Engaging with educational platforms, cryptocurrency forums, or webinars can provide valuable insights that help demystify the complexities surrounding Bitcoin investment.

Moreover, as the cryptocurrency ecosystem continuously evolves, being informed is paramount. Regulatory changes, technological advancements, and market sentiments can significantly impact the value of Bitcoin and other digital currencies. Thus, keeping abreast of these developments ensures that your investment remains grounded in sound knowledge.

For those looking to deepen their understanding, consider exploring reliable resources such as online courses on cryptocurrency, books authored by experts in the field, and reputable news websites that specialize in blockchain and digital currencies. Additionally, joining community groups and discussing with seasoned investors can provide support and increase your confidence as you navigate this exciting investment. Armed with information and a commitment to practice prudent investment strategies, your journey into cryptocurrency can be both rewarding and enlightening.